Prepaid virtual cards — an alternative to the usual

Many people still rely only on physical cards — the ones in your wallet or linked to your phone. But today, more and more are choosing prepaid virtual cards. They let you control spending and plan purchases in a way that works for you.

In this article, we’ll explain how these cards work, when they’re useful, and share a ranked list of three prepaid virtual card providers.

How a prepaid virtual card works

A prepaid virtual card is a banking product with its own details and balance. You load it with money, then use it to pay for purchases online or in physical stores if you connect it to a mobile payment service. The balance decreases only by the amount spent. There’s no credit limit — once the balance runs out, you’ll need to top it up to use it again.

2025 prepaid virtual card ranking

1. PSTNET

PSTNET issues virtual cards suitable for all types of online payments. They can be used for advertising, subscriptions, online shopping, booking flights, paying for hotels, and any other dollar-denominated online transactions.

To get an online prepaid Visa card, you register on the platform, deposit the amount you need, and then pay for the chosen card. There’s no limit to how many you can create, you can issue as many as you need, whenever you need them.

Features:

- No fees for transactions, withdrawals, or operations with blocked/frozen cards

- No limits: You choose the top-up amount yourself

- Top-up methods: 18 cryptocurrencies (including BTC, USDT TRC20/ERC20, ETH), other Visa/Mastercard cards, and bank transfers (SEPA/SWIFT)

- Registration: Google, Telegram, WhatsApp, Apple ID, or email

- Security: 3D Secure, two-factor authentication

- Support: 24/7 assistance via Telegram chat and other channels

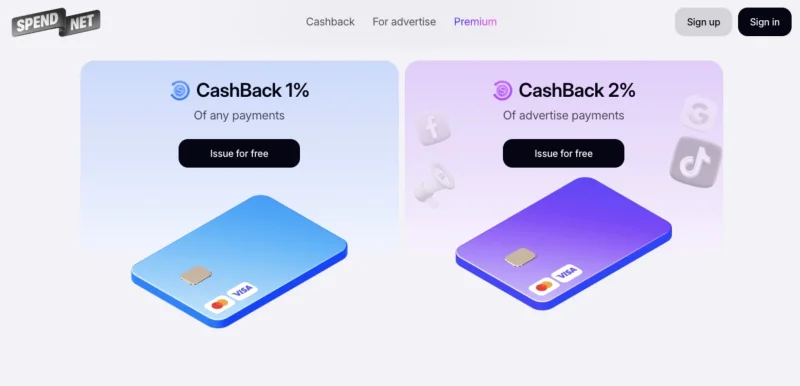

2. Spend.net

Spend.net is a financial platform for issuing virtual cards. Users can choose between cards for advertising or general-purpose dollar cards. All cards are free and work worldwide via Visa and Mastercard.

The main Spend.net advantage: cashback on every purchase. No matter what the card is for, you automatically get 1% of each payment back.You decide your own spending limits and the number of cards you issue. You can also control top-up fees — on average from 2%. All other operations are free.

You decide your own spending limits and the number of cards you issue. You can also control top-up fees — on average from 2%. All other operations are free.

Features:

- No fees for transactions, declined payments, currency conversion, refunds, or withdrawals

- Security: 3D Secure

- Top-up methods: USDT, BTC

- Registration: Google account or email

- Support: 24/7 via live chat in your account

3. Ezzocard

If you need a card instantly without providing personal details, Ezzocard makes it possible. Anyone, anywhere can visit the website and buy a one-time card without registering. Perfect for situations where you need a card for a limited period, a single payment, or just want to stay anonymous.

Cards come in various denominations and are accepted in most international stores and services. No top-up is required — the card comes preloaded. This is especially handy for paying for subscriptions, services, or ad budgets without extra steps. Denominations range from $10 to $2,000.

Features:

- Top-up methods: 9 cryptocurrencies (including BTC, USDT TRC20)

- Registration: Not required — buy directly on the website

- Security: One-time cards without protection technologies

- Support: 24/7 via email

How to use prepaid cards

- For family and personal spending

One practical use is for controlled spending. For example, a parent can issue a card, top it up with a set amount, and share the details with a teenager. They can pay for an online course or order food, but they can’t spend more than the balance — the bank won’t allow it to go negative.

- For international subscriptions

You can have a dedicated card for services that don’t accept local bank cards. Load exactly the monthly subscription fee in foreign currency. Once the service charges the card, the rest stays untouched — no surprise charges if the price changes.

- For business trips

Companies often give employees prepaid cards for work travel. The card holds the budget for transport, meals, and accommodation. Even if the exchange rate shifts, payments go through at the bank’s current rate. Funds stay separate from personal money, making expenses easier to track.

- For large or occasional purchases

If you shop online often, a virtual card can help with discipline. Only top it up before a big purchase — choose the item, check the price, then add funds. With no leftover balance, impulse buying becomes less tempting.

- For charity and group spending

Some people use a separate prepaid card for donations. They transfer a set monthly amount to it and spend only on charitable causes. This keeps such expenses separate from personal and household spending. Another example is group travel. Everyone contributes to one prepaid card, which is then used for hotels, tickets, and car rentals. Everyone can see the balance and track spending.

What to check before choosing

Providers offer different conditions. Some let you choose the card currency at issuance. Others make topping up easy via popular e-wallets. Some allow quick issuance via a mobile app.

It’s worth checking if the card works with Apple Pay or Google Pay — useful for paying with your phone or watch. In some cases, a plastic version is available, handy where contactless isn’t accepted.

Topping up with a goal

You can top up in advance or only when needed. For example, if you shop on marketplaces often, it’s convenient to load the card before each purchase. This way, you always know your exact spend. Unlike a general account, where expenses mix together, here each payment is linked to a specific purpose.

Conclusion

Prepaid virtual cards are easy to issue and top up. They’re convenient for specific purposes — from personal budgeting to work expenses. The main thing is to pick a provider that suits your needs. We’ve covered how they work and when they’re useful. Now it’s your turn to choose the one that works best for you.

Ti potrebbe interessare:

Segui guruhitech su:

- Google News: bit.ly/gurugooglenews

- Telegram: t.me/guruhitech

- X (Twitter): x.com/guruhitech1

- Bluesky: bsky.app/profile/guruhitech.bsky.social

- GETTR: gettr.com/user/guruhitech

- Rumble: rumble.com/user/guruhitech

- VKontakte: vk.com/guruhitech

- MeWe: mewe.com/i/guruhitech

- Skype: live:.cid.d4cf3836b772da8a

- WhatsApp: bit.ly/whatsappguruhitech

Esprimi il tuo parere!

Ti è stato utile questo articolo? Lascia un commento nell’apposita sezione che trovi più in basso e se ti va, iscriviti alla newsletter.

Per qualsiasi domanda, informazione o assistenza nel mondo della tecnologia, puoi inviare una email all’indirizzo [email protected].

Scopri di più da GuruHiTech

Abbonati per ricevere gli ultimi articoli inviati alla tua e-mail.