7 Essential stock analysis Tools Dominating the Market

Introduction

In the hectic world of stock trading, having the right stock analysis tool to analyze earnings and forecast prices can make or break your investment. When everything else in this hyper-aggressive industry is ultra-modern, why are you struggling with outdated hardware? Whether you are an experienced trader looking for additional insight to support your advanced strategy, or a beginner in need of advice, there is an audiobook that fits your needs.

In this post, we are going to reveal the BEST 7 stock analysis tools of 2025 selected just for you. We’ve reviewed each choice in terms of important aspects, such as features, prices, user interface/experience and value for money to help you find the perfect tool fitting your specific requirements. So jump on in and find the absolute best solutions to take your stock analysis game to the next level!

Website List

1. BestStock AI

What is BestStock AI

Comparison to other platforms: BestStock AI aims for AI alogrithms enhancement of investment strategies, automation of data processing and actionable reports. Its focus is on financial professionals who require massive amounts of data, market intelligence and customized, easy-to-run reports that allow them to make faster, data-driven decisions — without the need for manual analysis. Leveraging cutting-edge AI, BestStock AI automates the research and offers the insights that enable you to be a smarter investor. Furthermore, BestStock AI includes a Capital Gains Tax Calculator that helps users to calculate tax dues easily and maximize their after-tax returns with investment decisions.

Features

- Financial analysis through AI, which can process data without human intervention and suggest actionable insights

- Complete corporate financial intelligence, including full US stock financials and earnings transcripts

- Stay in the know with a personalized feed of AI powered insights and curated research to make better investments everyday

- Next generation statistical and business analytics to inform your financial decisions.

- Intuitive user interface to support efficient work flow for investment teams

Pros and Cons

Pros:

- AI-powered insights that automate data prep to identify trends faster and accelerate decision-making

- Unlimited access to US stock financials, earnings transcripts & curated research

- User Friendly design to ensure frictionless research for its users

- Customizable pricing options for all investment team types

Cons:

- It might be more expensive than other alternatives.

- Some partial offline modes exist that also support the extraction and processing of data.

- Leveraging all aspects to their fullest will take a non-trivial investment in learning.

2. WallStreetZen

What is WallStreetZen

WallStreetZen is a research analysis site that offers stock market data, charts and financial tools for those who invest part-time. It’s major value proposition is its Zen Ratings quant model which uses 115 proven factors to find A rated stocks that have the tendency to outperform, with an average annual return of 32.52%. Equipped with stock screens, best analyst recommendations and premium services, WallStreetZen make investing decisions simple for its users.

Features

- Proprietary Zen Ratings system uses a complex algorithm fusing 115 elements to calculate the best stocks

- A rated stocks that average 32.52% annual returns to date prospective add up profits

- Gain access to top analyst insights and recommendations for your investment strategy decisions

- Live stock ratings and market trends to make smart investment decisions on the go

- Full set of analytics, including valuation analysis and relative performance comparison by industry

Pros and Cons

Pros:

- A potential for high returns with the A-rated top stocks that have an average annual return of 32.52%

- Culling from 115 proven variables to select the best opportunities for investing

- Get expert analysis, actions and insight & how they impact you from experienced analysts offers a brilliant decision-making with every swipe.

- Easy to use platform w/ features built for investors making strategic decisions

Cons:

- Limited data on degree of stock research beyond ratings

- Subscription fees could be a deterrent for penny-pinching investors

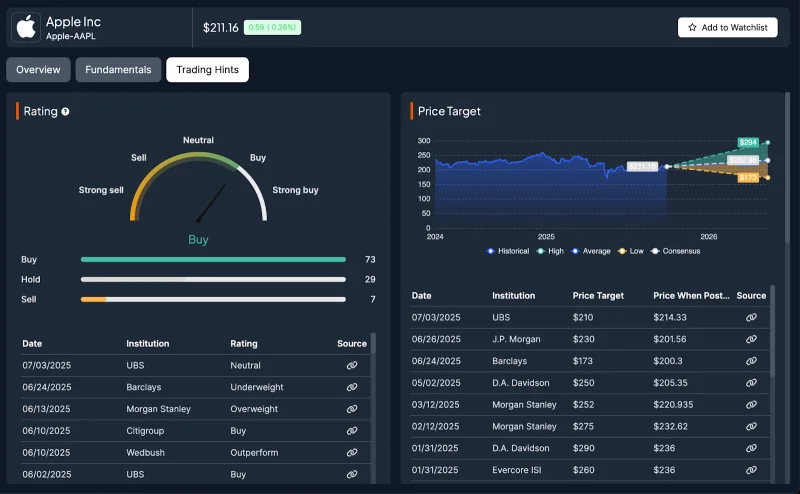

3. TipRanks

What is TipRanks

TipRanks is a financial technology platform that allows investors to simplify the stock research process, making better investment decisions. The primary mission is to provide individually – stock market intellegence and guidance, and now occasionally risk adverse exposure in order to empower users with transparency. by seeing how often analysts’ published ratings are actualy useful allowing them the actionable intelligence that leads to wise investment decisions, instead of having to read volumes of outputs. By combining its data with research and easy to understand information TipRanks provides the investment tools, user-friendly aspects and education that make for informed trading, mitigating risk in stocks.

Features

Leading models from the world of machine learning that customize recommendations based on user behavior

Ease of use dashboard that makes site navigation easy for users of all levels

Chat and file sharing capabilities in real time to help with team collaboration

Detailed information and visual reports to monitor progress and performance

Synchronize across devices by directly accessing data from a different device or drive

Pros and Cons

Pros

- With TipRanks for Experts, you can verify contributors’ track records in real-time and premiums trustworthy analysts while remaining two steps ahead.

- The platform provides consolidated analyst ratings, price targets and earnings estimates for thousands of stocks.

- The company’s AI-based Financial Accountability Engine generates unbiased performance assessments of Wall Street professionals.

Cons

- The subscription costs for pro features a steep price tag for some casual investors.

- The collection of third party analyst data means that updates might occasionally be slow to come through.

- Its emphasis on expert rankings could obscure other investment methodologies or independent research.

4. MarketWatch

What is MarketWatch

MarketWatch is a financial information website that provides business news, analysis, and stock market data. Its primary goal is to provide investors and finance enthusiasts with timely insight, analysis and the tools necessary to make wise financial decisions in today’s rapidly changing world. Featuring a mix of breaking news, market data, and personal finance articles, MarketWatch offers people who are beginning to filter out the noise from Wall Street a far-reaching selection of over 30 investment information channels where they can conduct their due diligence.

Features

- AI-based solutions for higher productivity and more efficient work;

- Intuitive design, suitable for all levels of experience

- Features for easy collaboration and project management.

- Plenty of powerful data-visualization tools to glean actionable insights and drive strategic decisions

- Multi platform service through one account, you can use this service in all smart devices that offer downloaplay including smartphone, tablet, PC, Smart TV and etc.

Pros and Cons

Pros

- MarketWatch Market Watch gives you the option to track up to 8 different markets, and it’s very specific across the markets it follows.

- Its personalized watchlists allow traders to track stocks, ETFs and other asset classes seamlessly.

- The platform connects with Barron’s and Dow Jones, providing top-of-the-line insights for big investors.

Cons

- It also lacks comprehensive fundamental data and analysis tools, making it less useful for in-depth stock research.

- It lacks crucial resources such as earnings call transcripts and forward estimates, so it is less useful for deeper analysis.

- Some of the more advanced features are available only with a premium account, so budget-minded users may be hesitant to sign up.

5. Zacks

What is Zacks

Zacks Investment Research is one of the most highly regarded firms in the investment industry. It primarily aims to help investors with their stock market analysis and earnings strategies. Zacks makes its research available to charge paying customers through its website Zacks.com and to unauthorized users in his bulletins, blogs, press releases and company summary reports.

Features

- Investing commentary from seasoned strategists to help you make sense of today’s markets

- Detailed examination of economic data that affects financial markets

- Analytical tools to forecast markets and shifts at a glance

- An investment program built to maximize returns during different economic periods

- Resources that are available to both beginners and experienced investors

Pros and Cons

Pros:

- Possibility of enhanced market optimism as rates cut could spur economic growth

- The good news releases the bank from concerns about inflation, which could translate into capital appreciation

- Chance to make strategic investment choices in line with changing economic conditions

Cons:

- Uncertainty over timing, execution and efficacy of rate cuts on market performance

- Market volatility may prompt investors to react to changing economic signals

- Danger of becoming addicted to monetary policy, and losing focus on quarterly earnings and fundamentals

6. MarketScreener

What is MarketScreener

MarketScreener is a financial information website with cutting-edge real-time information about the stock markets, the world of business and economics. Its primary goal is to provide investing and trading opportunities for its clients by offering high-quality, proprietary information, analysis, and reporting.FRWC covers market news as a breakthough website dedicated to represents the positive aspects that drive economic changes within the financial markets. MarketScreener collects all the essential information to help you make your investments on the stock exchange.

Features

- Advanced machine learning that customizes your wonder and pleasing experience and maximizes performance

- The dashboard is easy to use which makes navigation a breeze for all level users

- Integration with communication tools for better collaboration and project management

- Advanced reporting and data visualization for more insight to the decisions made

- Interoperability that provides users with access and experience anywhere, anytime

Pros and Cons

Pros

- MarketScreener offers a complete worldwide market overview, with up to +5 years of historical data, over hundred percent indicators and indexes such as : shares, customers or suppliers of the sector / competitors, new buildings.

- Its heavily customizable stock screener offers some 650 fundamental and technical filters, providing a 360-degree view of companies.

- The platform provides live market data, free news, fast analysis and technical studies.

Cons

- Lots of cool features, including detailed financials and top-notch stock screeners, are reserved for paying subscribers though.

- The interface can get bogged down if tracking multiple stocks or assets simultaneously, which makes it a bit difficult to control during high-speed trading.

- The mobile app is “dumbed down” compared to desktop versions, and lacks capabilities for more advanced features like complex screeners and in depth analysis.

7. StockAnalysis

What is StockAnalysis

StockAnalysis is a complete online platform that offers you access to free detailed stock information, covering over 100,000 stocks and funds for all the companies in S&P 500. Its primary objective is to equip investors with precise stock rates, financials, breaking news and analytical tools that allows them to make appropriate investment decisions. Equipped with such tools as stock screeners, watchlists and market-mover updates, StockAnalysis is an invaluable tool for inexperienced and veteran investors alike seeking to navigate the stock market successfully.

Features

- Full database with well organized information on more than 100,000 stocks and funds to help take the guess work out of choosing investment items

- Real time prices and financial news to keep you informed of market trends

- Powerful stock analysis tools to help you make investment decisions with confidenceOPTARG- It boasts a screener and comparison tool for strategic planning OPTARG

- User friendly interface for easy access to key metrics and insights

- Ongoing updates to features and information as required by changes in the market and user feedback

Pros and Cons

Pros:

- Comprehensive data on tens of thousands of stocks and funds, including all stocks in the site’s Free and Premium stock screeners (available during market hours)

- Easy-to-use stock screener for effortless analysis of market movers

- Real-time stock prices, news and financial forecasts

- Daily updated top gainers and losers for informed decision making

Cons:

- Light on exposure to international stocks and processes

- Information could be overwhelming for beginner investors

- Nothing about mobile access or app functionality

Key Takeaways

- The stock analysis method best for you is based on your investment goals and risk tolerance.

- Rely on historical performance and fundamental metrics to guide your decisions – don’t simply chase trends

- Real-time data and state-of-the-art tools can help you make better trading decisions

- An easy-to-use interface with immense educational material can speed up your market learning.

- Real-time information flow and expert insights into market changes can be seen as an additional source in the process of decision-making.

- Risk management services and diversification products are very important, to protect your investment

- Interacting with a community of traders and relying on quality research can really to improve your stock analysis capabilities

Conclusion

In summary, this detailed analysis of the best 7 stock analysis solutions will give you deeper insights to help you make more informed choices in an overly competitive marketplace. All of these options come bootstrapped with different strengths and capabilities, so choosing the right one is of utmost importance as per your needs, finances, and long-term prospects.

The stock analysis landcape keeps changing rapidly and new features and improvements are added frequently. We suggest you begin with the answers that most closely fit your purpose and ponder also on how flexibly they could adapt to you as those needs change. There’s a reason the most expensive isn’t always the best and maybe you don’t want these features to begin with, so try to judge what suits your needs.

Use free trials and demos to test these tools out yourself and ask customer support teams any questions you may have. The correct stock analysis software can be a game changer for your investment strategy and success, but it can be a hefty out of pocket expense. Get ahead now and search for the one tool that helps you make the best investment choices.

Ti potrebbe interessare:

Segui guruhitech su:

- Google News: bit.ly/gurugooglenews

- Telegram: t.me/guruhitech

- X (Twitter): x.com/guruhitech1

- Bluesky: bsky.app/profile/guruhitech.bsky.social

- GETTR: gettr.com/user/guruhitech

- Rumble: rumble.com/user/guruhitech

- VKontakte: vk.com/guruhitech

- MeWe: mewe.com/i/guruhitech

- Skype: live:.cid.d4cf3836b772da8a

- WhatsApp: bit.ly/whatsappguruhitech

Esprimi il tuo parere!

Ti è stato utile questo articolo? Lascia un commento nell’apposita sezione che trovi più in basso e se ti va, iscriviti alla newsletter.

Per qualsiasi domanda, informazione o assistenza nel mondo della tecnologia, puoi inviare una email all’indirizzo [email protected].

Scopri di più da GuruHiTech

Abbonati per ricevere gli ultimi articoli inviati alla tua e-mail.